Information Note1

Ensuring adequate retirement incomes for all Australians is an important issue facing the nation, as emphasised in the 2015 Intergenerational Report.2 Because superannuation contributions are based on earnings from employment, female labour force participation is potentially an important factor. While the rate of female labour force participation has risen substantially in recent decades, it is still substantially below the male level. In this note, we model the impact of different female labour force participation scenarios on retirement incomes using Treasury’s newly developed long-term dynamic microsimulation model of Australia’s retirement income system, MARIA (Model of Australian Retirement Incomes and Assets).

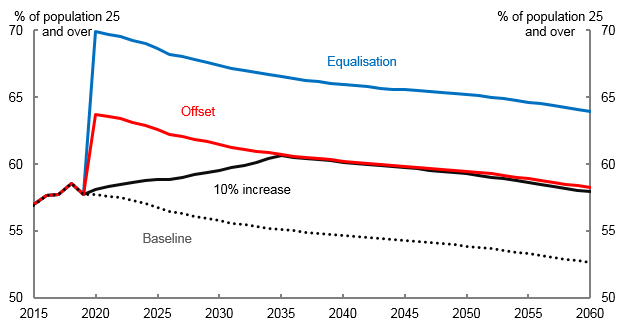

The first scenario is a substantial, but relatively plausible, 10 per cent increase in female labour force participation, phased in over 15 years. The second, less realistic, assumes instant equalisation of female participation rates to male levels, resulting in a 17 per cent increase in female labour force participation from 2020. The third assumes a convergence of both male and female participation rates to the average for both sexes, with a decrease in male participation rates offsetting the increase for females. See Chart 1 below.

Chart 1: Female participation rates

Higher labour force participation increases female retirement incomes, and reduces pension reliance and expenditure (except where it is offset by lower male participation). However, these results take a very long time to materialise. Pension reliance and expenditure in 2060 are affected by the labour force shocks introduced in the first year in 2020. The nature of the system means that it takes a long time for the impacts to stabilise following any change.

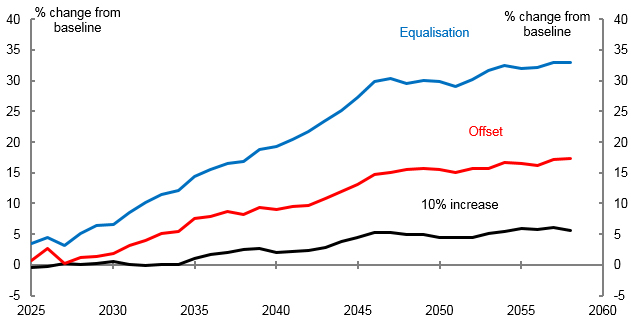

The impact of the scenarios on the Age Pension is small relative to the scale of the labour force change. Only the second scenario (equalisation at male participation rates) reduces pension reliance and expenditure by more than 10 per cent. The effects on women’s retirement incomes are somewhat larger across the scenarios, although not dramatic, apart from the equalisation scenario (chart 5). The 10 per cent increase in participation scenario, relative to the baseline, raises women’s average retirement incomes by about 5 per cent. This reflects the fact that participation is only one factor impacting retirement incomes. We make no assumption about increasing female earnings or reducing the gender pay gap.

Chart 5: Female mean income at retirement (5-year moving average)

[1] The views expressed in this note are those of The Treasury and do not necessarily reflect those of the Australian Government. This note was prepared by Declan Trott, Wei Ying Soh, and Martin Stevenson and Rita Scholl in Revenue Group.

[2] Commonwealth of Australia (2015), 2015 Intergenerational Report: Australia in 2055, Commonwealth of Australia, Canberra.